UK’s bank card market is much less fun than the US and some other countries. Although it’s home to many Fintech companies, the only worthy product remaining in the point-earning world is Curve, which I use on a very regular basis.

And that is why I got very excited to learn about MyGuava, a payment solution that has some innovative and interesting perspectives. Before we start, I must point out that MyGuava doesn’t have a proper UK bank license, which means your money is not FSCS-protected – proceed with caution.

[Fees]

MyGuava is (mostly) free to apply and use. There’s no fee for getting a physical card, money transfer, and ATM withdrawal in the UK. However, you need to pay for the following services:

- Foreign currency spend: 0.5%

- ATM withdrawal abroad: 1%

- Topping up using a bank card: 1.5%

[Cards]

As soon as you’ve opened a MyGuava account it comes with a debit card already. According to their website and app there’s “up to 0.6%” cashback for card spend. I couldn’t find any specifics, and my experiences are very mixed and random:

- 0.3% cashback at Lidl

- 0.6% at other supermarkets and some shops

- 0% at TFL contactless and other shops

By common sense I assume cash-like and financial services payments are excluded, but I don’t know if all regular transactions will attract that 0.6% cashback otherwise, which is extremely generous for a no-fee debit card.

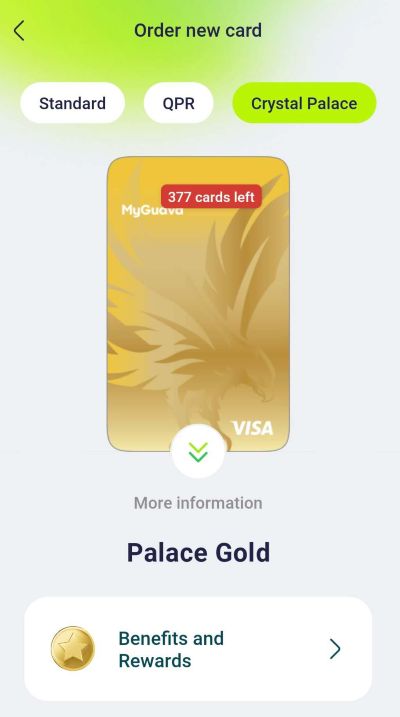

MyGuava has some other card accounts that you can open, including co-branded cards with a couple of UK football teams – QPR and Crystal Palace. Besides the “up to 0.6%” cashback there are additional benefits:

- 7% cashback at sports shops (up to £150 cashback per month)

- Highest spenders of the month / quarter / year will be gifted swags and game tickets

Although limited in quantity, these special cards are free to claim and you can request a physical one sent to you. Given those extra perks there’s no reason not to.

[UnionPay]

Here’s a quirky feature in case you travel to China – besides the Mastercard and Visa card accounts mentioned above, you can also open a UnionPay card account.

UnionPay is China’s own payment card service (think Visa and Mastercard) and you are probably familiar with its logo if you’ve been to China or the most popular tourist destinations. UnionPay is almost a monopoly in China and they also issue cards overseas, although it’s very rare.

So why do you want a UnionPay card when in China?

- Card and cash payment are not widely accepted in the country

- Instead, you pay with Wechat / Alipay, backed by your bank card

- Although overseas Visa / Mastercard / Amex cards are supported, 3% fee is applicable to payment over 200 RMB (~$28)

- Overseas UnionPay cards are also supported with no fee

(Update: looks like their UnionPay card cannot be added to Alipay or Wechat, in other words – useless!)

Note that MyGuava charges a 0.5% non-Sterling fee, and their exchange rate might not be the best. Still, it’s much better than paying 3% and don’t forget the 0.6% cashback.

[Paypoint]

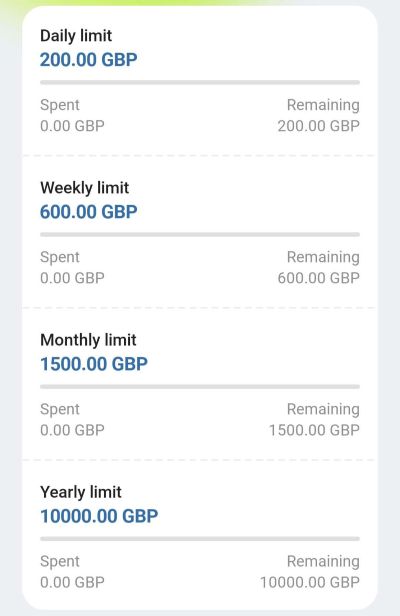

Besides bank transfer, you can also top up your MyGuava account at Paypoint (for example Co-op). You should be able to pay using a credit card too.

Refer to the image above for limits. I did it at a Co-op and the £200 showed up within 10 minutes.

[Referral Bonus]

New members can get a referral bonus when signing up to MyGuava:

- Open my referral link on your phone or enter promo code GPPNJOXCEQNZ

- Order a physical card

- Make at least three in-person purchases, and spend £100+ using the physical card within 30 days

- You’ll earn £30 referral bonus

The referral promotion ends on March 10th. You’ll likely need a UK passport or driver license for the KYC check, as there’s no physical biometric permit anymore and I don’t think they accept e-visa.

I am also new to MyGuava and still in the process of exploring, but it does seem to add a new flavour to the points game. Please let me know if you have experiences with them.

Their website lists

Cashback 0.3% local – up to 0.6% global on eligible transactions

But on the football club branded cards some show 0.6% local, not sure which is correct

It’s quite messy according to my experience (football cobranded card):

– TFL contactless: no cashback

– Lidl: 0.3%

– Other supermarkets and online shopping: 0.6%

Any updated referral program for new members?

Don’t think there’s an active one now