[Background]

The credit card market in the United States is way more competitive than anywhere else in the world, and as a result the payment cards offer substantially higher bonuses and better benefits than, say, the UK. Take American Express as an example, it’s not uncommon to see the same card hands out 3x the sign-on bonus plus better day-to-day perks.

Interested in getting a card in the US? It’s actually much easier than you think. First of all you don’t have to be a Resident Alien (I still find the term very amusing) to be eligible, although you do usually need to have a tax identification number, i.e. SSN or ITIN. They are similar to the National Insurance number in the UK, and you need to provide them when submitting a credit application.

There are workarounds though, especially with American Express. We wrote about its Credit Passport feature a while back which approves your US credit card application using your UK credit history. In fact there’s an even easier route, as long as you are already an Amex customer in another country.

The feature is called Global Transfer, and you can read more about it on Amex’s website. You only need to meet the following criteria to apply:

- Be an existing Amex customer

- Have an address in the destination country to receive the card

- Have a telephone number in the destination country

You don’t need a credit history in the destination country, and in the context of United States, nor do you need SSN or ITIN. It works in a similar fashion with Credit Passport, but utilises your client record with Amex instead, which I imagine is in your favour.

In theory you can global transfer from any country to any other country, as long as Amex does business in both of them. There are few exceptions (such as China) due to local financial regulations.

[Why Global Transfer]

As I’ve just mentioned, Amex cards in the US are much better than the UK counterparts from almost every perspective. It’s critical to choose the right card to start with, as you can only request one via Global Transfer and you’ll be stuck with it for a while. (Anecdotes suggest that you may apply for two card simultaneously if applying by phone).

I started with the Platinum card mainly because they were offering a huge sign-on bonus. Compared to the UK version, the US one has the following advantages:

- Better earning rate (1 point / $1)

- Frequent conversion bonus to airline / hotel programs

- No foreign transaction fee

- Priority pass with +2 guests

- Annual credit for FHR and US airlines

You can also transfer UK membership rewards points to the US one at the current exchange rate.

I don’t see myself holding the US Platinum card in the long term, but as I said it’s just a start point.

[Making an application]

We all love earning referral bonuses, but you can’t do global transfer and refer a friend at the same time. You should start your application on Amex’s website, and some public partner offers work too (for example this one from Resy).

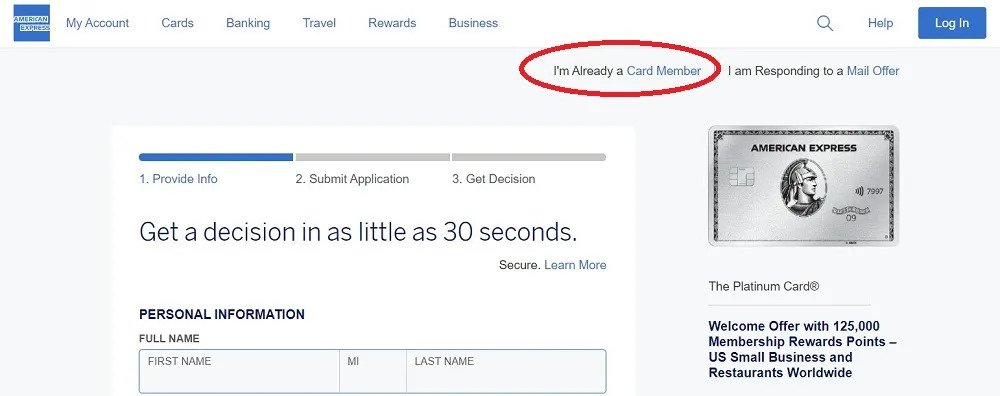

The procedure is quite simple. When applying, click I’m Already a Card Member at the top right:

Sign in using your Amex UK credentials and the form would come back partially pre-filled.

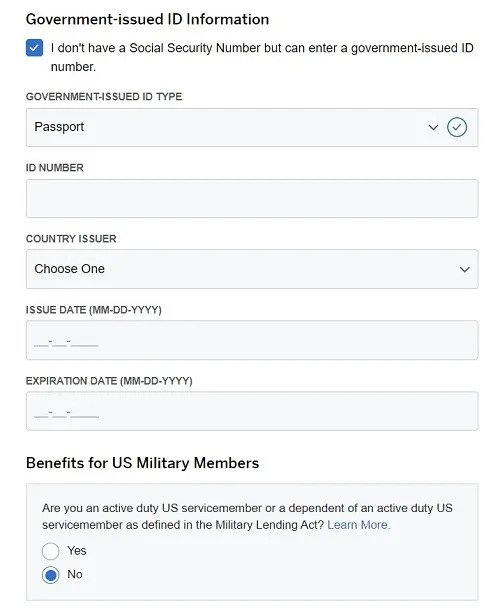

Tick the box declaring that you have no SSN, and fill out the remaining information including your passport number, US address and phone number.

Assuming that you’ve been a great client of Amex, your application should be approved right away.

[Receiving the card]

If you are not physically present at the shipping address, whoever receives the card should forward you the necessary information to activate it.

Since Amex supports Google Pay / Apple Pay, adding the card to your e-wallet should satisfy 99% of your use cases. In the unlikely event that you require a physical card right away, the safest route is probably ask your family/friend to send it across to you.

However, if you have the Platinum card, it’s also legit and straightforward to request a replacement card of an alternative design.

Go to online chat and ask the agent to add an alternate address to your profile, and you can enter your international (UK) address. You could choose a design and request it to be sent to your alternate address in the same conversation. My card arrived in five days.

Since it’s not a lost/stolen situation, the old card remains functional. I’m not sure how long you must wait after card opening to request the replacement though.

[Payment]

Since most (all?) US Amex cards charge no foreign transaction fee, you can use them safely in the UK and abroad. The next question you may have is probably how to make payment, which is surprisingly easy.

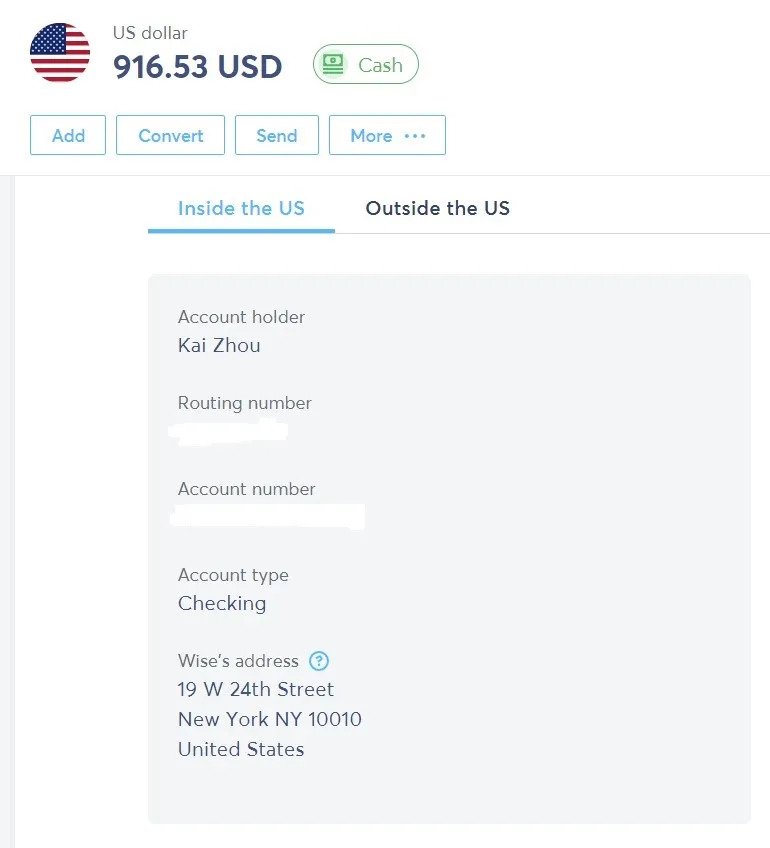

All you need is a Wise (formerly Transferwise) account. Once registered you can open a USD Personal Checking Account. They might need to verify your identity (e.g. UK driving license) which shouldn’t be a problem.

With the routing number and account number, you can link your Wise account in Amex online banking. It doesn’t work like Direct Debit in the UK though – every month after your billing date you still need to log in to Amex online banking and click a button to pull funds from Wise.

You can transfer your GBP funds in a UK bank to Wise’s USD account very easily. The exchange rate is favourable, and the handling fee is only about 0.3%.

If you are new to Wise, feel free to support us by using my referral link which gives you a fee-free transfer of up to €500.

[Conclusion]

I believe that’s all the essential information you need to know now. Once you’ve built up enough history with Amex, you can start applying for more cards, but that story is for another day.

Do you know if this is possible with such ease the other way around (i.e. do a Global Transfer from U.S. card to UK card)? Would the UK team scrutinize my info, or would a friend’s address and UK number suffice?

I don’t really know of such data point, but in general UK Amex is very relaxed in card approvals so my guess is you are most likely fine. Obviously there’s a chance that they ask for your proof of address and that’d be the dead end.

Ok, I guess I’ll try. The U.S. cards are good, but the hotel Amex Offers are always limited to U.S. only. The UK Amex Offers for hotels tend to be valid in multiple locations throughout Europe and the UK – way more relevant to my travel patterns and pretty much good as cash back for me. That’s the rationale behind such a Global Transfer play…